An emergency fund is the quiet hero of personal finance. In 2026—amid elevated living costs, variable job markets, and expensive credit—having cash set aside can mean the difference between a small setback and long-term debt.

So, how much emergency fund do Americans really need in 2026?

The old advice says “3–6 months,” but the right number depends on income stability, debt, family size, and access to credit.

This guide breaks down exact targets, where to keep the money, and how to build it fast—without wrecking your budget.

What Is an Emergency Fund?

An emergency fund is cash you can access immediately to cover unexpected expenses like:

-

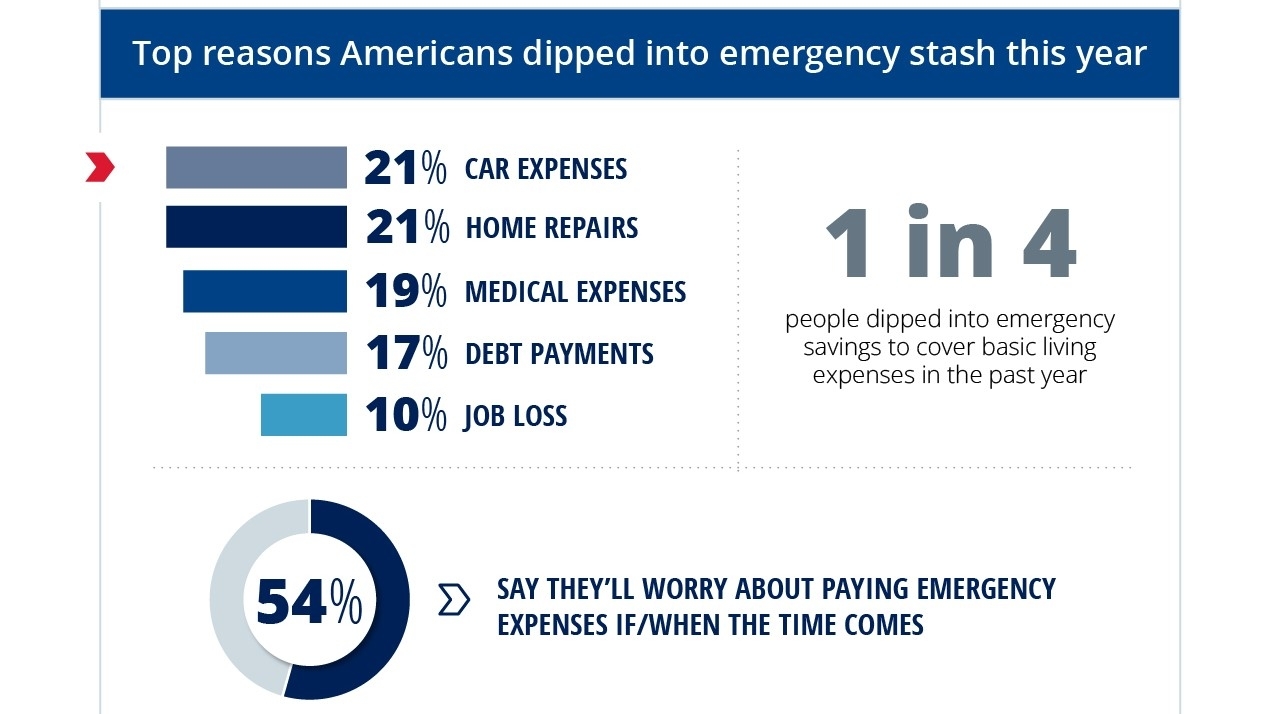

Job loss or reduced hours

-

Medical bills

-

Car or home repairs

-

Urgent travel or family needs

👉 It’s not for vacations, shopping, or investments.

The 2026 Reality: Why Emergency Funds Matter More

-

Credit card APRs still average 20%–29%

-

Personal loan APRs for many sit 12%–18%

-

One surprise bill can snowball into years of interest

Keeping cash handy avoids turning emergencies into high-interest debt—especially in a rate environment shaped by policies from the Federal Reserve.

How Much Emergency Fund Do You Need?

The Simple Rule (Updated for 2026)

| Situation | Target |

|---|---|

| Stable job, dual income | 3 months |

| Single income or variable pay | 6 months |

| Self-employed / commission | 6–9 months |

| High debt or dependents | 6–12 months |

👉 “Months” = essential expenses, not full lifestyle.

Calculate Your Number (Step-by-Step)

1️⃣ List Monthly Essentials

Include:

-

Housing (rent/mortgage)

-

Utilities

-

Groceries

-

Insurance

-

Transportation

-

Minimum debt payments

Example:

Essentials = $3,200/month

2️⃣ Multiply by Your Target

-

3 months → $9,600

-

6 months → $19,200

That’s your emergency fund goal.

Average Emergency Fund Benchmarks (USA, 2026)

-

Median monthly expenses: ~$3,000–$3,500

-

Common target range: $9,000–$21,000

-

Many households still have less than $1,000 saved

👉 Closing this gap is one of the highest-impact money moves you can make.

Where Should You Keep an Emergency Fund?

✅ Best Place: High-Yield Savings Account (HYSA)

-

4%–5%+ APY (variable)

-

FDIC/NCUA insured

-

Fast access

❌ Avoid:

-

Stocks/ETFs (market risk)

-

CDs (locked funds)

-

Crypto (volatility)

-

Checking (low interest)

📌 Interest earned is taxable and reported on Form 1099-INT per the Internal Revenue Service.

Emergency Fund vs Credit Cards

| Emergency Fund | Credit Card |

|---|---|

| 0% interest | 20%–29% APR |

| Immediate access | Can be limited |

| No debt | Creates debt |

| Peace of mind | Stress |

👉 Credit cards are backup, not the plan.

How to Build an Emergency Fund Faster (2026)

⚡ Start Small (Momentum Matters)

-

First goal: $1,000

-

Covers most minor emergencies

💸 Automate Weekly Savings

-

$50/week = $2,600/year

-

$100/week = $5,200/year

📈 Use Windfalls Wisely

-

Tax refunds

-

Bonuses

-

Side-hustle income

✂️ Temporary Cuts

-

Pause subscriptions

-

Redirect raises for 3–6 months

What If You Have Debt?

Priority order (general rule):

-

Minimum payments on all debt

-

$1,000 starter emergency fund

-

High-interest debt payoff

-

Full 3–6 month emergency fund

This prevents new debt during payoff.

Common Emergency Fund Mistakes

❌ Waiting to “feel ready”

❌ Investing emergency money

❌ Counting credit cards as savings

❌ Draining the fund for non-emergencies

Name the account “Emergency Only” to avoid temptation.

Final Thoughts (2026)

In 2026, an emergency fund isn’t optional—it’s financial insurance.

✔️ Start with $1,000

✔️ Build toward 3–6 months

✔️ Keep it safe and accessible

The best emergency fund is the one you actually build.